- Inspirational

- News

- 04 Oct 2025

Best Tools for Momentum Trading and Investing: Complete Beginner’s Guide (2025)

Momentum investing is a trading strategy in which investors purchase stocks or assets that are already trending in one direction with strength and definitive intent. The goal is to be a part of the trend until it slows or reverses direction.

Momentum trades can happen extremely quickly, and emotions can get in the way. This is why tools are so valuable to traders, because with the right tools, you can get in quicker, make better decisions, and protect your investment.

1. Charting and Technical Analysis Tools

Charts are the foundation of momentum trading. They show how prices are moving and help traders spot patterns, trends, and signals. Key Momentum Indicators:

(I) Moving Averages (MA): Show the average price over a period and confirm the overall trend.

(II) Relative Strength Index (RSI): Identifies whether a stock is overbought (too high) or oversold (too low).

(III) MACD (Moving Average Convergence Divergence): Highlights momentum direction and possible reversals.

(IV) Bollinger Bands: Measure volatility and signal possible price breakouts. (Popular platforms: TradingView)

2. Screeners and Data Analytics Tools

Screeners: The best categorial definition of screeners would be “a tool that provides a way to quickly identify stocks, or one or more investments that meet specific conditions”. Instead of running through thousands of stocks, you make a screener to fit the conditions you want. It then screens the stocks as long as you set your rules – for price, volume, performance, etc. With a screener, you could find companies that are moving up in price or companies that have a pattern of trading. (Popular platforms: Screener.in)

Data analytics tools: Data analytics tools are helpful when analysing a large amount of market data in order to understand some trends and patterns. Data Analytics tools show, for instance, the stocks which are performing well, the movement of the market, and whether parts of the stock world/ sector are strong. Traders will utilize the insights provided by analytics tools to make informed trading decisions.

Screeners help find the stocks you are looking for. Data analytics help when examining the market.

3. Algorithmic and Automation Tools

Algorithmic and Automation Tools are used in trading as software that can help you make decisions and perform tasks automatically. Algorithmic tools decide whether to buy or sell stocks according to certain rules or formulas based upon market conditions. The most appealing aspect of algorithmic tools is their speed; they can take advantage of opportunities faster than any human could, acting instantaneously. Automation tools instead, do repetitive tasks like placing market orders, tracking prices or sending alerts, without human interaction. They both follow the same framework in that they analyse data, make fast decisions, and automatically act for the trader, which saves time, limits mistakes and maximises profit.

4. Risk Management Tools for Safe Momentum Trading

Momentum trading can bring profits but also quick losses if the market turns. Risk management tools help protect capital and keep losses under control. Key Methods are as follows;

Stop-loss Orders: Automatically sell when the price falls below a chosen level.

Position Sizing: Decide how much to invest in one trade to limit risk.

Diversification: Spread investments across different stocks or sectors.

Risk-Reward Ratio: Check if the expected profit is worth the possible loss before entering a trade. Popular platform: Zerodha Kite.

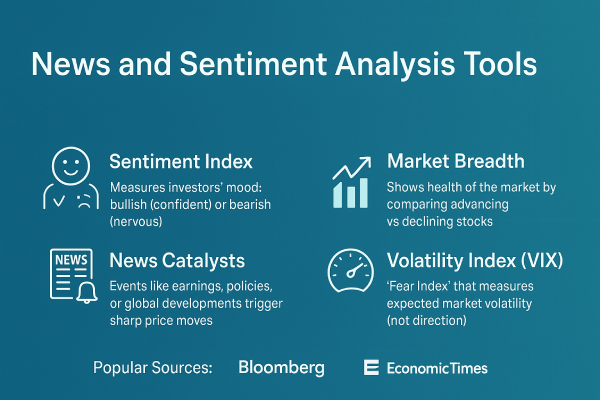

5. News and Sentiment Analysis Tools

Momentum is often driven by news and investor psychology. Tracking these factors helps traders stay ahead of sudden moves. Key Concepts are as follows;

Sentiment Index: A sentiment index measures the overall mood of investors in the market. It shows whether people are feeling confident and positive about buying (bullish) or nervous and negative about selling (bearish).

Market Breadth: Market breadth measures the overall health of the stock market by looking at how many stocks are going up compared to how many are going down.

News Catalysts: A news catalyst is any event or announcement that triggers strong movement in the price of a stock, sector, or even the whole market (Events like earnings results, government policies, or global developments).

Volatility Index (VIX): Also called the fear index, It measures how much investors expect the market to move (up or down) in the near future. It does not tell the exact direction of the move, but it tells whether traders expect the market to be calm or highly volatile (Popular sources: Bloomberg, Moneycontrol, Economic Times).

6. Conclusion

While momentum investing can be thrilling, it also takes discipline. One must remember that not all the tools available will give you profits; instead, they allow the trader to analyse better, act faster, and manage risk.

Momentum investing can be profitable if backed by the right tools and risk management. Whether you’re a beginner exploring momentum trading strategies or an experienced investor refining your approach, using charting platforms, screeners, automation, and risk control tools will help you trade momentum stocks more effectively in 2025 and beyond.

Leave a Reply